- Category intelligence

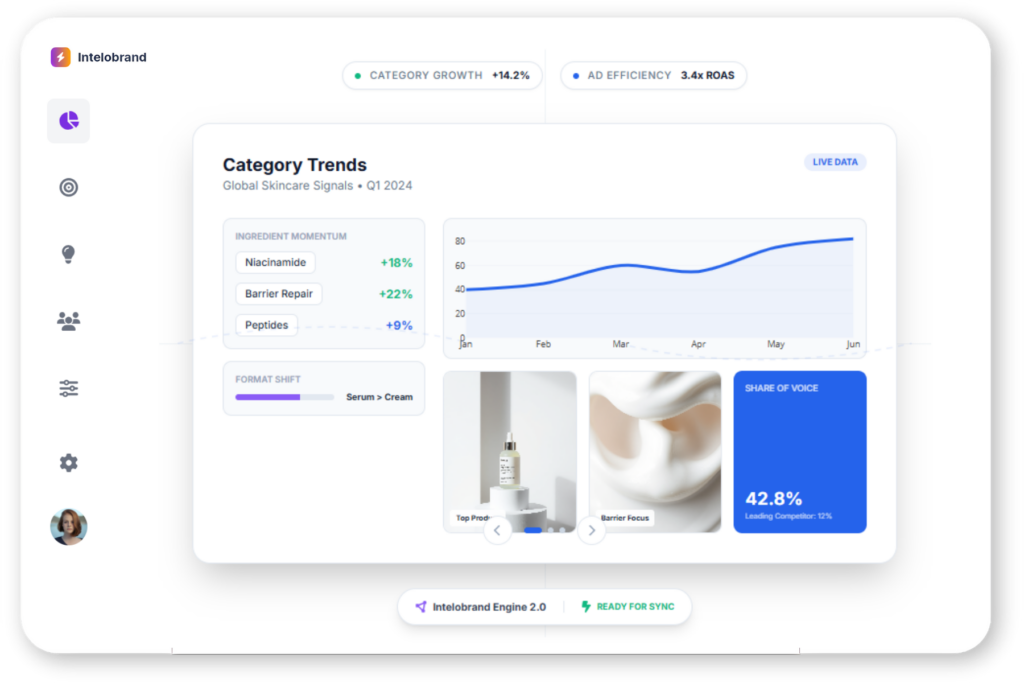

Category intelligence that reveals how markets evolve, saturate, and shift across brands and platforms

Category Intelligence analyzes ads, influencer content, offers, and messaging across brands to surface dominant themes, saturation signals, and emerging patterns—helping teams ground strategic decisions in how the category is actually behaving in real time.

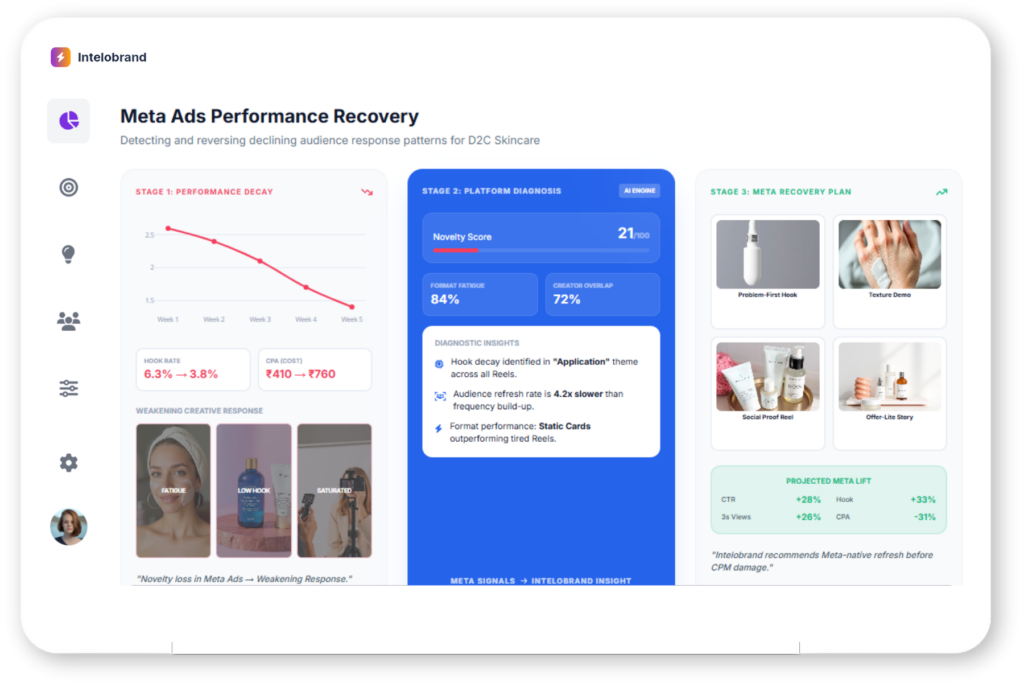

Category decisions fail when assumptions replace live, continuous observation of real market behavior

Teams frequently make category decisions using outdated research, limited brand examples, and internal beliefs—missing how quickly narratives, formats, and offers evolve across the market, resulting in delayed or misaligned strategic actions.

- Assumed Category Trends

Category trends are often assumed without continuous validation from live market intelligence, creating blind spots that distort strategic planning decisions.

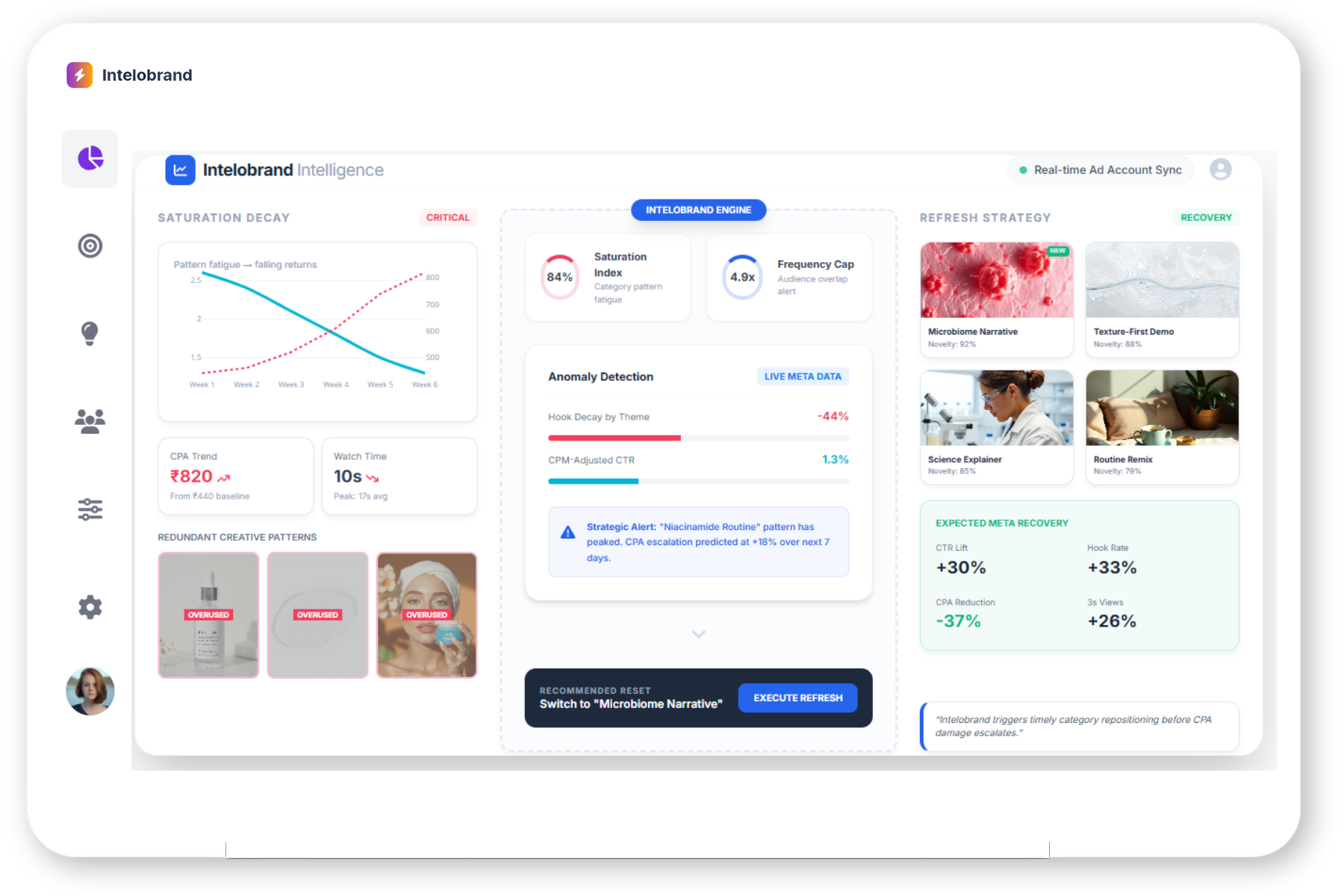

- Late Saturation Detection

Saturation frequently becomes visible only after growth slows, causing teams to miss critical windows for timely category repositioning.

- Selective Competitor Monitoring

Competitor activity is observed inconsistently across markets, limiting accurate understanding of competitive pressure and shifting category direction.

- Post-Peak Opportunities

Opportunities are often identified only after demand momentum peaks, reducing the potential impact of new strategic initiatives.

See recurring category patterns across messaging, creatives, formats, offers, and pricing signals

Category Intelligence aggregates live executions across brands to reveal recurring patterns—showing what the category communicates, which creative formats dominate, how offers are structured, and what pricing signals have become standard practice.

Common Category Narratives

Dominant stories repeated consistently across category campaigns.

Repeated Creative Formats

Frequently used creative formats shaping category communication norms.

Typical Offer Structures

Common promotional structures influencing buyer expectations across category.

Standard Pricing Signals

Recurring pricing cues shaping competitive market behavior.

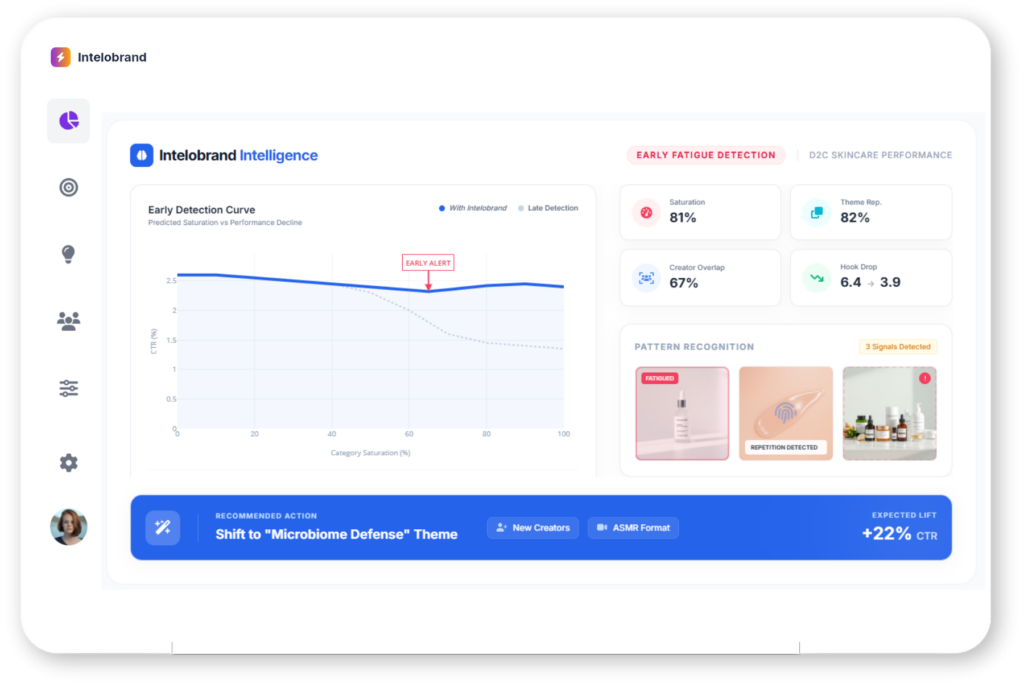

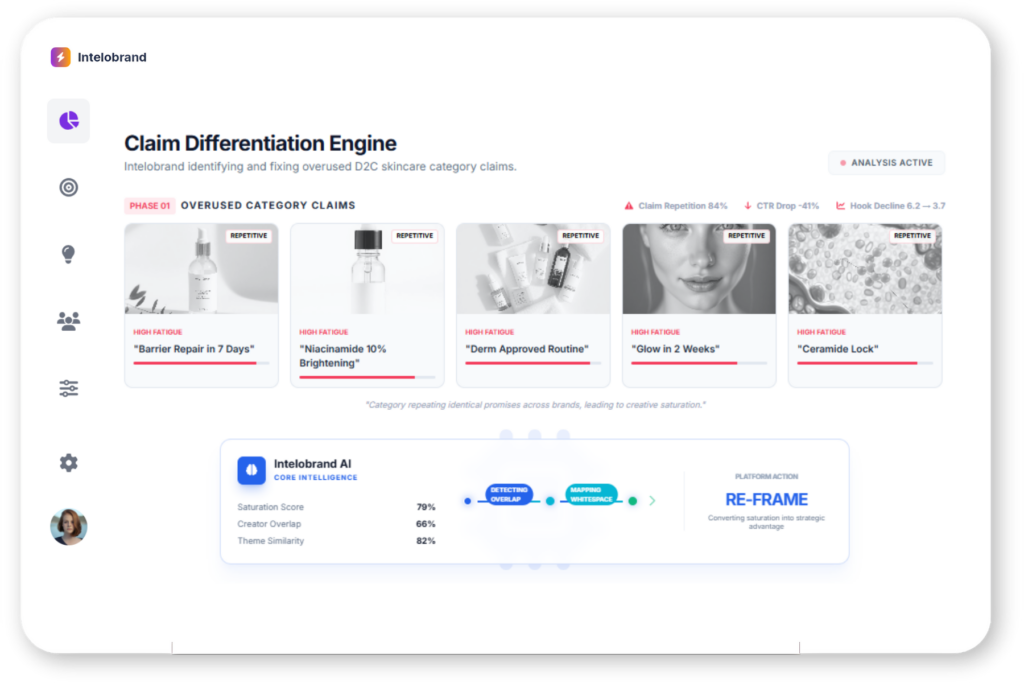

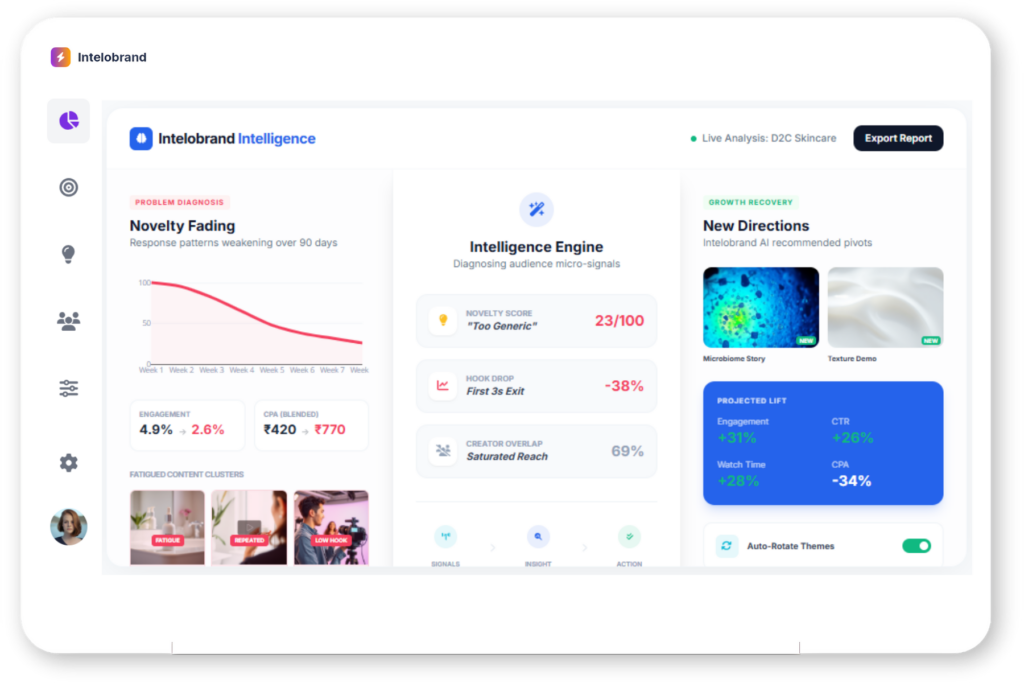

Understand when category ideas become overused and begin losing relevance and effectiveness over time

Category Intelligence highlights saturation by tracking how frequently narratives, formats, and offers repeat across brands—helping teams avoid copying late-stage category ideas that remain visible but continue declining in true performance impact.

- Overused Category Claims

Common category claims are repeated excessively across competing brands, gradually reducing audience attention and diminishing overall message effectiveness.

- Repeating Creative Structures

Similar creative structures appear repeatedly across competitor campaigns, making differentiation increasingly difficult for individual brands to maintain.

- Declining Response Patterns

Audience response patterns weaken as category ideas lose novelty, resulting in lower engagement and decreasing campaign effectiveness.

- Late-Stage Category Ideas

Late-stage category ideas often appear popular while actual performance impact has already begun declining significantly.

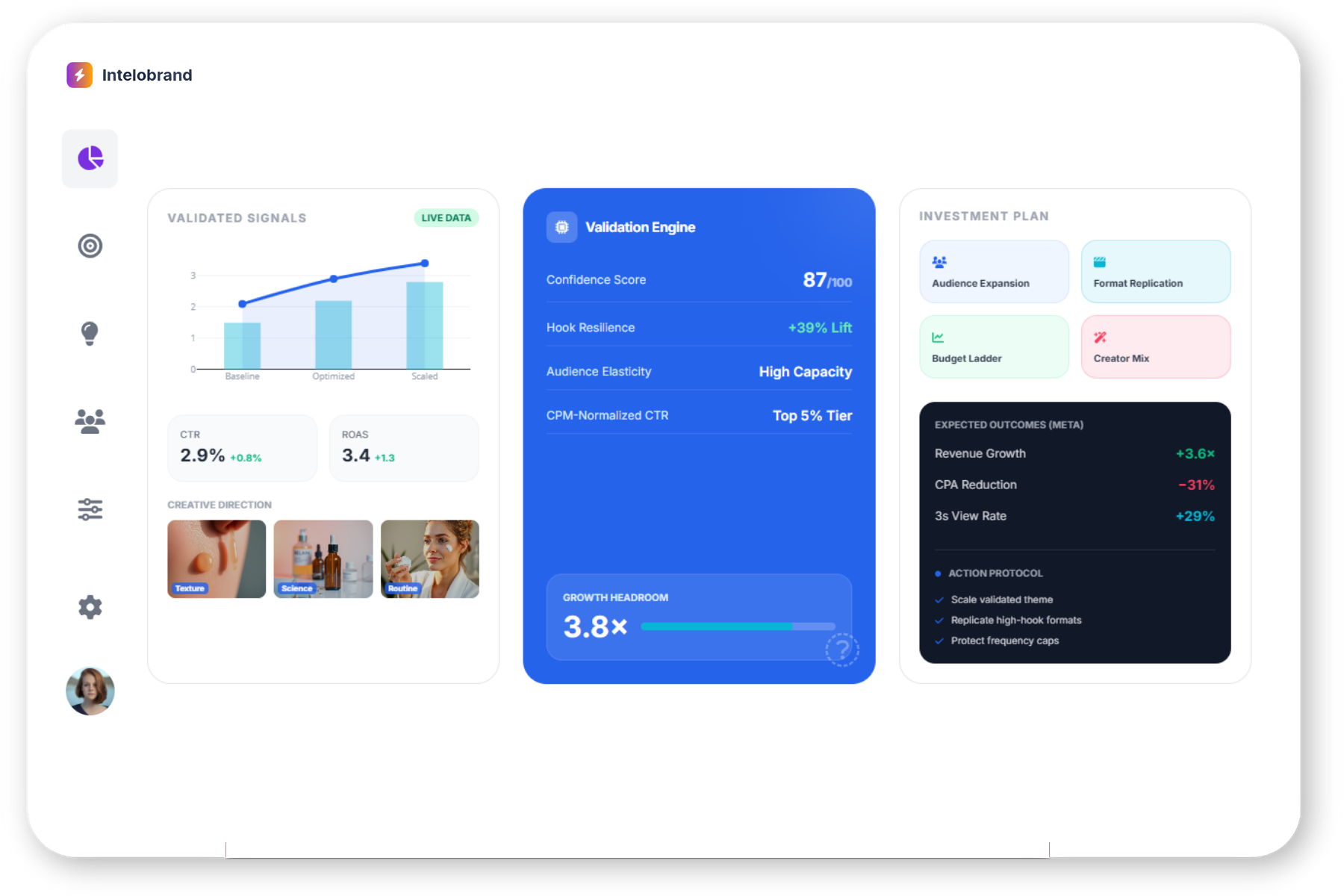

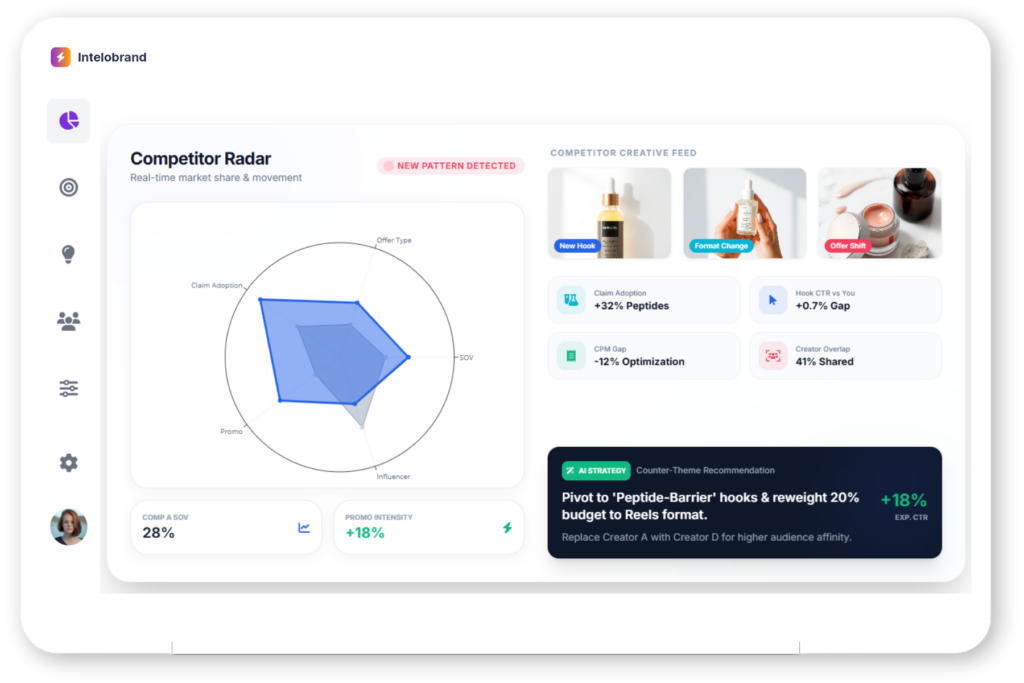

Detect early category shifts and messaging opportunities before they become crowded

Category Intelligence surfaces early signals of change—new narratives, creative approaches, offers, and pricing moves gaining traction—helping teams enter emerging spaces before competitors scale and saturate opportunities.

Emerging Category Themes

New narrative themes gaining traction across category.

New Creative Approaches

Novel creative techniques appearing within category executions.

Underused Value Propositions

Promising value propositions competitors have not fully claimed.

Early Growth Signals

Rising engagement and adoption signals across category.

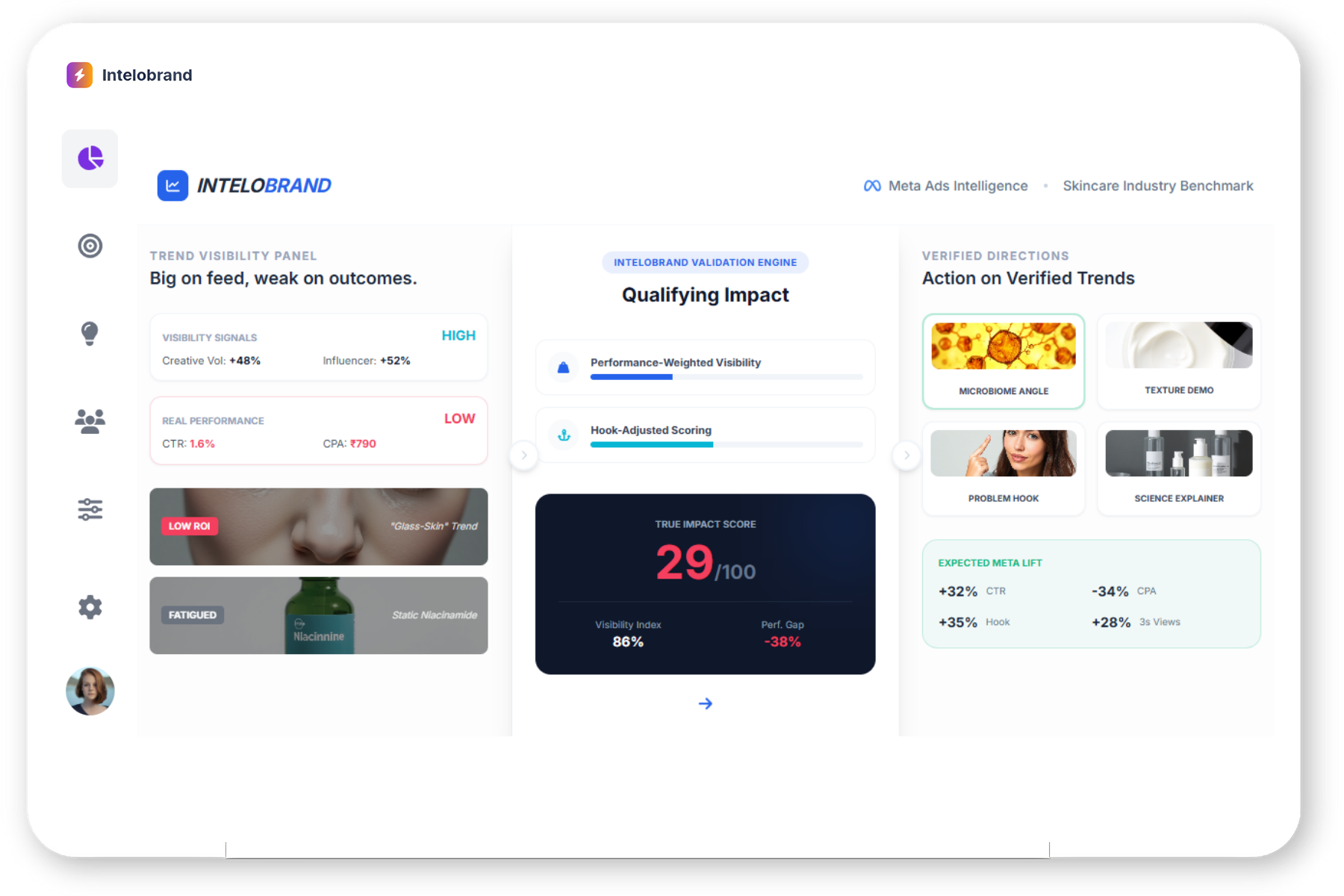

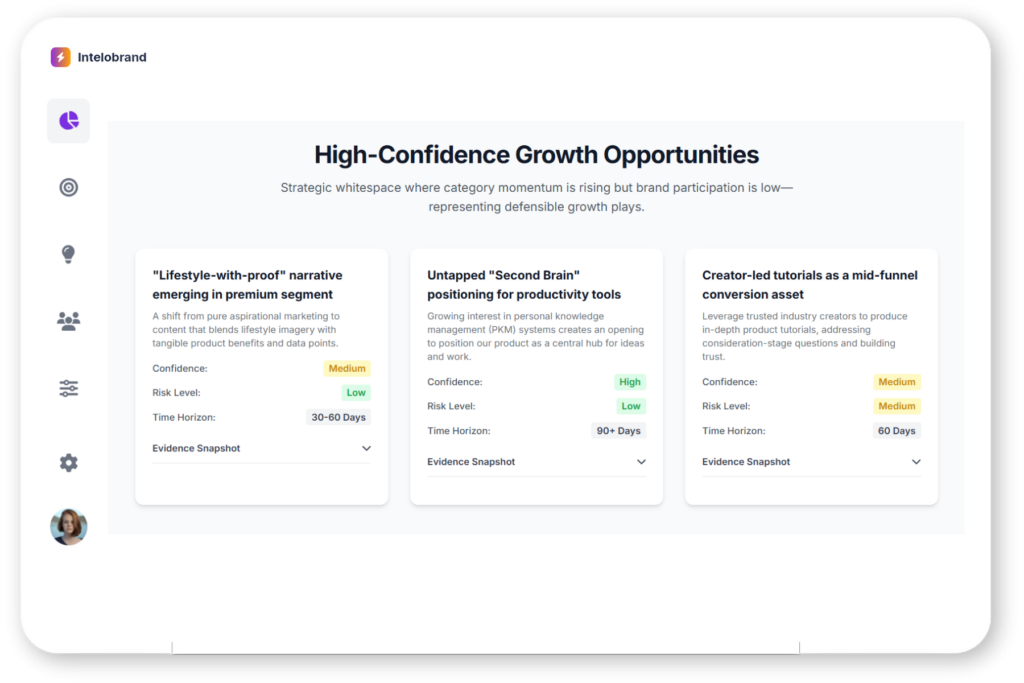

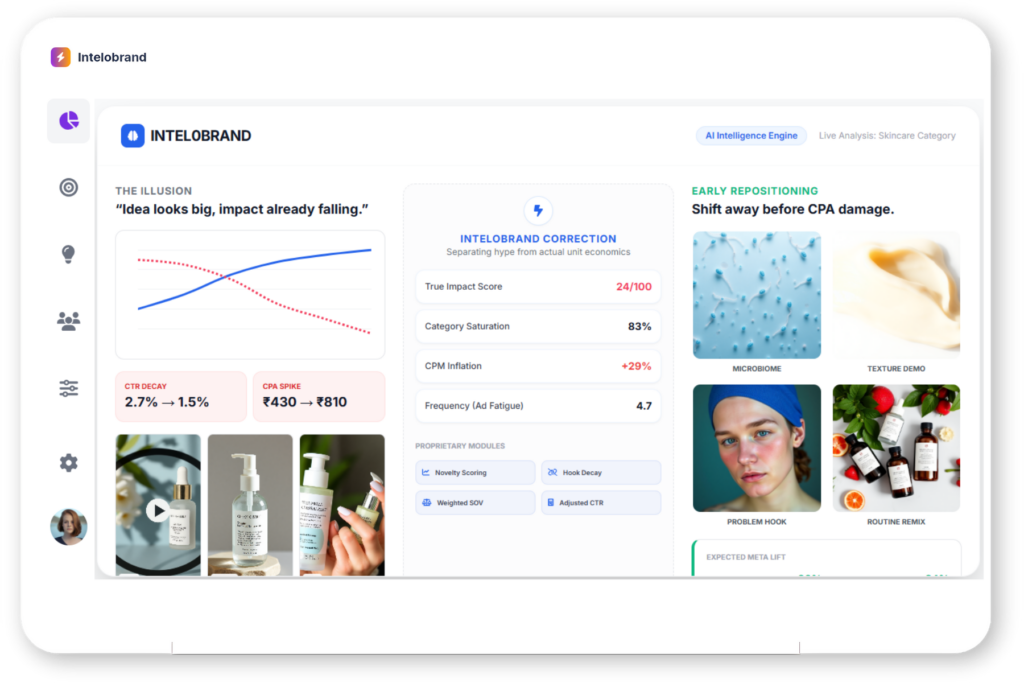

Validate category trends using performance data, not just visibility or constant repetition alone

Category Intelligence connects category-level narratives, formats, offers, and pricing signals with performance data—allowing teams to distinguish between highly visible trends and those consistently delivering measurable business results across brands and time.

- High-Visibility Trends

Highly visible trends frequently generate attention without delivering meaningful performance outcomes that support long-term business growth objectives.

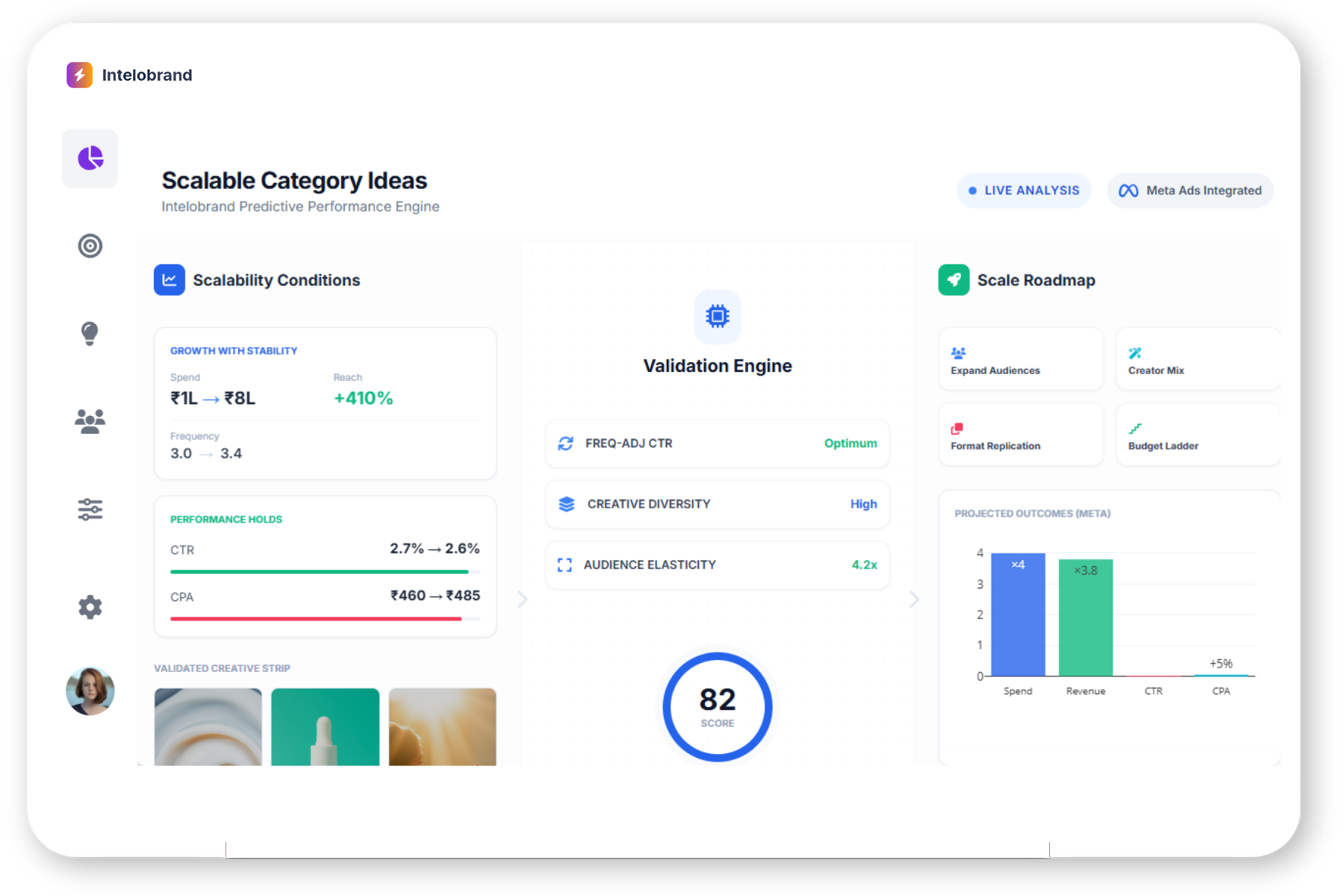

- Scalable Category Ideas

Scalable category ideas consistently support efficient growth by delivering reliable performance outcomes across brands, channels, and market conditions.

- Declining Saturation Patterns